Dear National Credit Union Administration,

You win, we lose.

This is our notice of Voluntary Liquidation of the Internet Credit Union.

We write this hoping many of you will read it.

You did not need to crush this credit union.

You did not need to make it take over 18 months to charter, forcing 5,000 changes to our application documents.

You did not need to restrict our total loan portfolio to $37,000 when we had $1,000,000 in reserve for bad loans.

You did not need to keep us from lending $8,000 to a student, forcing him from college.

You did not need to keep us from originating mortgages for permanently affordable housing.

You did not need to keep us from working with other credit unions on their loans and our loans.

You did not need to force us to revoke the membership of our migrant farm worker members.

You did not need to send people into our offices every month for 2 years taking up our time.

You did not need to treat us like children. And yes, your people said they were “treating us like children” in a meeting with our board.

You didn’t need to laugh when Occupy sent you an application to start a credit union, snarking

”That is not going to happen.” And yes, an NCUA official said that while we were in your offices in DC.

You do not need to overreact every time the Federal Reserve sends you a letter like you did over bitcoin.

You do not need to sow fear into every small and medium sized credit union with your subjective rating system.

You can stop hurting, and start helping.

You need to stand up to the banks that want our membership rules to be arbitrary and shifting under us.

Technology has made starting and running a Credit Union easy.

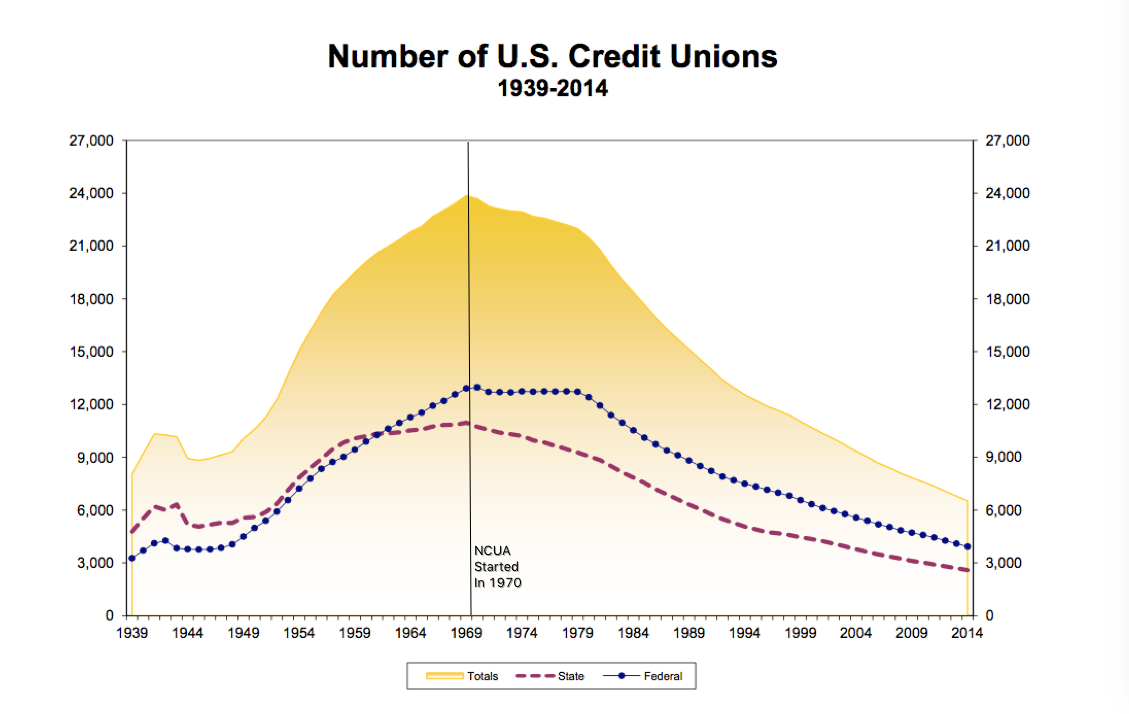

We need you to not shut down 200 to 300 Credit Unions a year.

We need you to not start 1 or 2 Credit Unions a year, but start 500 credit unions a year (as used to happened before the NCUA existed).

You can create a 5 page application, that any group can submit in a month to get started.

You can leave new credit unions alone for a couple of years.

Clean house of your agents of shutdown, and replace them with agents of start-up.

Thousands of communities are not geographically clumped, let them start credit unions.

27% of our citizens are “underbanked” – your organization is part of the reason for this.

We need a distributed and robust banking system for deposits, transactions, and grassroots credit.

NCUA: Please fix yourself.

We need you… We need you to change.

Your Sincerely,

Members of the Board of the, now dead, Internet Credit Union

Internet Credit Union 2011-2015

sources: Credit Union National Association, NCUA (via the Wayback Machine)

This is an absolute disgrace. So much for free association of sovereign individuals. Thanks to the ICU board for their hard work and vision in this murdered experiment.

Nothing would make more of a difference in this world than a truly independent parallel financial system operated by its users according to verifiable rules that contribute to their own goals. This is why all the agents of the centralized financial power structure have done everything they can to delay and undermine the success of cryptocurrency until they are sure it can be controlled for their own benefit through some overwhelming initial advantage.

If I could purchase land with Bitcoin, I would convert to it entirely. I have already had experimental periods of up to 2 months (including rent and food) using only bitcoin.

Impressive to live on bitcoin completely. The Internet Archive did a showing of Life on Bitcoin. really fun. http://lifeonbitcoin.com/

I felt my Archive account was hacked.Could you tell me how to examine my login record please?

I sent this to the Internet Credit Union person, Kathy.

i never really thought bitcoin was a big deal till now, im surprised its still around.

Pingback: Credit Union Fails To Help Bitcoin Companies Due To Regulations | Crypto Coin News

Pingback: Credit Union Fails To Help Bitcoin Companies Due To Regulations - Business 4 portal , B2B B2C

Pingback: Credit Union Can’t Help Bitcoin Companies | Money & Tech

RIP? I think it’s: RIA – Rest in Agitation.

Wishing you the best as you continue to go forth and multiply.

Appreciate you sharing this story Brewster, even if it was a difficult. I have thought of starting a financial co-operative but reading this… the regulatory hurdles seem to great. Even with all your capitol and expertise I’m surprised it couldn’t be done.

In the previous post and here you show the graph and discuss the stats of credit unions declining in the US. It is my understanding that most merge voluntarily to offer better banking services. Specifically online and mobile banking which most people expect nowadays. Do most CUs voluntarily merge or are forced to by the NCUA? They could offer online services easily through a backend provider but the NCUA prevents it?

I am curios to know why you attempted to start our own credit union? Could’t the Internet Archive have just utilized an established CU in New Jersey or elsewhere? Could you have piggybacked another CUs services with your own branding and eventually moved loans and deposits over to your own charter? Perhaps this could be done as a state CU charter?

Did you personally use CUs before attempting to do this? I’m curios since while I hate dealing with “red tape”, if you had/have some of your money in a CU are you not somewhat reassured there is an agency that safeguards consumer assets? I’m not saying that the NCUA does everything right.

I’ve used a CU in my area before and it is one of the largest in the area. (MECU in Baltimore.) Tbh, a majority of MECU employees are incompetent, unhelpful, and somewhat rude. Also the online services were behind the times. I moved to an online bank and have been happy. Recently through I have considered joining another CU with more robust service. Likely I’d go with a larger credit union not a smaller one though. You still believe there is a market for small CUs to thrive?

What do you think can be learned from the ICUs demise? What do you think would need to change for adequate oversight and safeguards while fostering growth and innovation with US credit unions?

Thank you for writing.

You said:

“It is my understanding that most merge voluntarily to offer better banking services.”

In my limited experience, CU’s are forced into mergers. Good banking services are super easy at this point because of offerings like CU*Answers that does all the modern backend services including online banking, debit cards, etc.

The reason to set one up was to try to help employees get housing and to see if we could help others create 1000’s of small credit unions by leveraging the same infrastructure.

But we lost.

What I learned is we need to reform the NCUA to help small credit unions rather than have them crushed out of existence.