Brewster Kahle, Chairman of the Internet Archive Federal Credit Union, November 2015

[NYtimes story, Motherboard, BoingBoing. Liquidation.]

All deposits are safe, all loans performing, great and dedicated staff, wonderful members. So why difficult? Despite five years of effort, $1 million in donations spent (from the Internet Archive) and $1 million in the bank to back any bad loans (from the Kahle/Austin Foundation), we are only further from our goal: To create a financial institution that can justly serve our communities. It now looks likely that overwhelming regulatory burden will force us to give up our quest. But don’t worry, even in this case we have more than enough money for all depositors and can place our few outstanding loans. So all is safe, but we thought we should give an update.

Started in New Brunswick New Jersey in January 2011 and then chartered 19 months later, we invested in growing our membership based on a dream of a new kind of credit union, but now our membership is shrinking because the regulators (the National Credit Union Administration, or NCUA) kept tightening our requirements for membership. Also, the services they allow us to offer have been restricted to payday-like loans and small car loans– ones we were not excited to offer in the first place and not lucrative enough to break even. So now we serve only about 100 members and a total of about 400 account holders, and we are not even serving them in ways we wanted to. We wanted to do 3 types of things, none of which we are succeeding at, which makes losing money even harder to endure.

We wanted to help the under-served, but the restrictions made this too difficult. We tried to offer student loans, but we were limited to lending only $5,000. This was a particular problem when, for example, an under-documented local Rutgers student with a 700+ credit score and a part-time job needed $8,000 to stay in school but others would not help him. We sought an exception from the NCUA, but they said no. In another case, we worked with a migrant farm workers association to offer their members access to the credit union. We set up a system that allowed them to send money back home with much lower fees than organizations such as Western Union. We had set up services to help undocumented workers so they could pay their fair share of taxes and put them on a path to citizenship. But after ruling that we could accept members of this migrant farm workers as members then a lower level examiners reversed this decision and we had to move all of those members to non-members effectively killing our relationship with the migrant farm workers association. Also, our members wanted to send outgoing wire transfers but the NCUA would not allow it resulting in many members leaving. You probably get the idea, we certainly did.

We wanted to create permanently affordable housing by offering targeted mortgages. With the banking crisis leading to millions going into foreclosure, we thought we could find ways to help. With abundant capital for our credit union (in this case donations) and experience from Jordan Modell, a banker of over 20 years, we built a great team, board, and partnerships, we gave it a whirl. We were encouraged by how generous the other credit unions and community members were. But as I said, the regulators never let us lend more than $5,000 to anyone much less originate mortgages. The Internet Archive has made progress anyway in affordable housing by starting a “Foundation House,” but unfortunately the credit union is not allowed to build on this example.

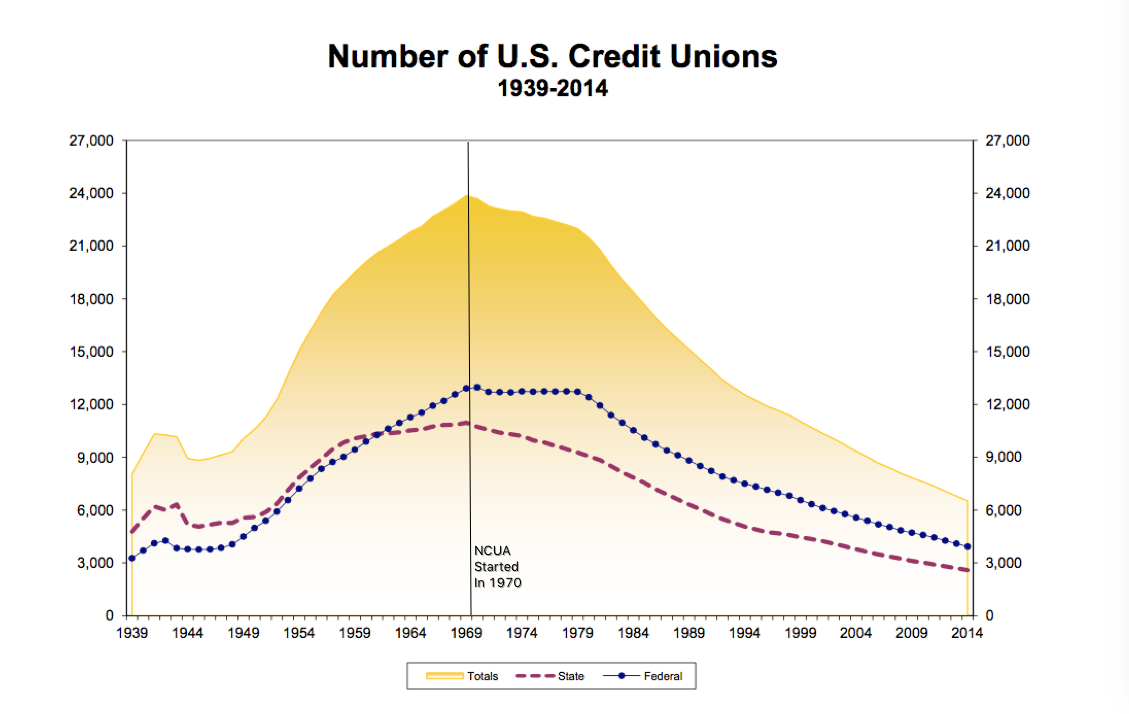

We also wanted to make a model so that thousands of credit unions could be started to serve their local communities as happened in the 1930’s and 40’s. Our CEO, Jordan Modell, wrote a blog so others might learn from us and spent hundreds of hours with others wanting to start credit unions. But even though it is logistically easy to start and run a fully functional credit union given the technology back-end services available today, the regulators made it very hard to succeed. After a year and a half of full time work on our application, and their demands for 5,236 changes (really) to our application documents, we were learning they were not interested in new credit unions. We found that generally only a handful of new federal credit unions are allowed to start each year. One of the four our year was a Navajo credit union that spent 44 months getting through the process. We were stunned to find we were the first full service credit union chartered in New Jersey since the NCUA was formed 1970.

After years of losing money I asked our board, which included several that ran credit unions, “How do we break even?” They said we should find those that need services that are financially lucrative, and they suggested we look to our unique relationship with the Internet. Since we were prevented from making significant loans, we thought that maybe we could get enough deposits and invest them in CDs and wait for the NCUA to let us serve the communities. Fortunately there was an opportunity was opening up. In 2013 bitcoin firms were in the news and banks were closing their accounts. The Internet Archive had some experience with bitcoin because people had donated bitcoins for a couple of years. The Internet Archive used them as partial pay their interested employees, to buy books at the neighborhood bookstore, and buy sushi next door. I suggested the credit union present at a bitcoin conference, which was well received. Our credit union asked permission from the NCUA to bank bitcoin companies and they granted it. We opened accounts for three small firms. All good– until it wasn’t. The NCUA suddenly demanded we close the accounts. So we reluctantly closed them forcing one of the companies into bankruptcy. The NCUA suggested we open accounts for the individual customers of one of the failed firms so they could receive their money. But then the NCUA kept auditing and investigating us at a level that often took more hours than what we spent on all member services combined. They have been in our branch now around once a month for 2 years, driving up our costs and driving down our services.

sources: Credit Union National Association, NCUA (via the Wayback Machine)

I don’t think it is just us. For sure, we made mistakes but also had unusual advantages: experienced banker CEO, almost unlimited capital, and a market that wanted alternative banking options. I now believe it is not just us, because 200 to 300 credit unions are shut down every year, many of which by the NCUA which was started in 1970. Only a few are allowed to start. All the while, it has never been easier to create and operate a small full-service credit union, complete with debit cards, ATM’s, and online banking. We have heard many tales from other credit unions and the associations that try to help new ones that echo our experiences. “By any measure, the future for small credit unions looks bleak,” says the Financial Brand. We now know first hand how they go after small and medium sized credit unions and force them to merge their assets into bigger credit unions. If you have an account in a credit union, especially a small or medium sized one, I would worry that they will go after yours.

I told my tale of woe to a friend, John Markoff, at a party and he suggested I tell it to another New York Times reporter Nathaniel Popper, who turned out to be interested. Few go to the press because there is little upside as the regulators hold absolute power and could react negatively to critical press.

We decided to go to the press as part of our original idea– share our experience so others may learn from us. Unfortunately, we do not have a successful model for others to copy. It may have just been us, but I don’t think so. The United States may not be the place to sustain a grassroots community banking system, at least one that has anything to do with the existing regulators. Maybe the regulators will change, and there are some bringing up issues. Maybe people will build a new system, but so far, the US regulators are aggressively resistant. Maybe some other country will be interested in new ideas and welcome entrepreneurs. Maybe other credit unions that have felt crushed by the regulators will come forward and tell their stories creating momentum for change. I see a system as unhealthy if regulators put 200 to 300 institutions out of business every year for decades on end while only allowing a few to start.

Part of the reason the regulators may act this way is how technically insecure the money system is. As an engineer, when I looked at how the transaction systems work, I was shocked to see few technological safeguards. I imagine there is major fraud activity. Ironically, the bankers and regulators need exactly the technologists that they are pushing away.

All in all, we are sad. Many people have spent years building a new credit union and we have little to show for it. We had hopes. When I was young I had a passbook from my village’s savings and loan– they helped me save my paperboy money so I could spend it on my stamp collection. But through the 80’s I saw the regulators, and the de-regulators, take our beloved savings and loans across the country and roll them up and blown them up– mine was gone in 1989. I wonder if this is what is happening to our small and medium sized credit unions.

More as it happens, but these are difficult times for our credit union. Thank you for all of the help.

Appendix:

Number of Credit Unions in the United States and the number change each year (NCUA started in 1970). Source: CUNA.

|

Year

|

Number | Yearly Change |

| 1939 | 8,035 | |

| 1940 | 9,224 | 1,189 |

| 1941 | 10,316 | 1,092 |

| 1942 | 10,272 | -44 |

| 1943 | 10,158 | -114 |

| 1944 | 8,930 | -1,228 |

| 1945 | 8,823 | -107 |

| 1946 | 8,944 | 121 |

| 1947 | 9,130 | 186 |

| 1948 | 9,320 | 190 |

| 1949 | 10,062 | 742 |

| 1950 | 10,586 | 524 |

| 1951 | 11,278 | 692 |

| 1952 | 12,280 | 1,002 |

| 1953 | 13,690 | 1,410 |

| 1954 | 15,067 | 1,377 |

| 1955 | 16,192 | 1,125 |

| 1956 | 17,246 | 1,054 |

| 1957 | 18,191 | 945 |

| 1958 | 18,860 | 669 |

| 1959 | 19,512 | 652 |

| 1960 | 20,094 | 582 |

| 1961 | 20,604 | 510 |

| 1962 | 20,984 | 380 |

| 1963 | 21,363 | 379 |

| 1964 | 21,800 | 437 |

| 1965 | 22,109 | 309 |

| 1966 | 22,680 | 571 |

| 1967 | 23,029 | 349 |

| 1968 | 23,420 | 391 |

| 1969 | 23,866 | 446 |

| 1970 | 23,687 | -179 Year the NCUA Started |

| 1971 | 23,267 | -420 |

| 1972 | 23,098 | -169 |

| 1973 | 22,982 | -116 |

| 1974 | 22,940 | -42 |

| 1975 | 22,677 | -263 |

| 1976 | 22,581 | -96 |

| 1977 | 22,382 | -199 |

| 1978 | 22,203 | -179 |

| 1979 | 21,981 | -222 |

| 1980 | 21,465 | -516 |

| 1981 | 20,784 | -681 |

| 1982 | 19,897 | -887 |

| 1983 | 19,095 | -802 |

| 1984 | 18,375 | -720 |

| 1985 | 17,654 | -721 |

| 1986 | 16,928 | -726 |

| 1987 | 16,274 | -654 |

| 1988 | 15,709 | -565 |

| 1989 | 15,121 | -588 |

| 1990 | 14,549 | -572 |

| 1991 | 13,989 | -560 |

| 1992 | 13,385 | -604 |

| 1993 | 12,960 | -425 |

| 1994 | 12,551 | -409 |

| 1995 | 12,230 | -321 |

| 1996 | 11,887 | -343 |

| 1997 | 11,659 | -228 |

| 1998 | 11,392 | -267 |

| 1999 | 11,016 | -376 |

| 2000 | 10,684 | -332 |

| 2001 | 10,355 | -329 |

| 2002 | 10,041 | -314 |

| 2003 | 9,709 | -332 |

| 2004 | 9,346 | -363 |

| 2005 | 9,011 | -335 |

| 2006 | 8,662 | -349 |

| 2007 | 8,396 | -266 |

| 2008 | 8,089 | -307 |

| 2009 | 7,830 | -259 |

| 2010 | 7,605 | -225 |

| 2011 | 7,351 | -254 |

| 2012 | 7,070 | -281 |

| 2013 | 6,795 | -275 |

| 2014 | 6,513 | -282 |

Pingback: RT @brewster_kahle: New York Times on how the Feds… « telesle on twitter

Out of principle I’ve banked exclusively with US credit unions for over 10 years, subsequently they have all been NCUA members. The experience has been terrifyingly dysfunctional. Members of the NCUA have incredible potential to serve their communities, and to improve upon the profit driven banking industry, instead all this potential is wasted.

I am sorry your experience with credit unions have been bad. There are now back-end services that can make it easy to set up a credit union with debit cards, atm’s, wire services, etc. But the NCUA has to allow it. And they often don’t.

I’m sorry to see this project did not succeed. I don’t know anything about banking or credit union regulation but perhaps an alternate strategy to achieve similar aims would be to start with a “normal” credit union deposit / loan portfolio and then begin to gradually offer these non-traditional products. I imagine that you attracted so much regulatory scrutiny because of the perception of risk. If you build a stable portfolio and then experiment with a small percentage of that portfolio so that overall risk is within a comfortable margin, the regulator is reassured. Once you have demonstrated that these non-traditional products do not add additional risk you can then increase the percentage of the portfolio devoted to them.

We did start small and risk free, and we never were allowed to do more, even over several years. With little opportunity to make revenue, it made it costly. Everything we did was approved of, until it wasn’t, and then we stopped. In the end, they drained us of money and energy.

grrr! You put in more time, effort and money than any reasonable person would or could so two thumbs up for the effort and intention. Two thumbs down for the regulators behind the curtain.

Thank you, dwf. We really did try. And many many others are really trying.

I find the chart of the number of credit unions going down each year by 200-300 since the NCUA was founded to be quite a dramatic picture of what is wrong.

I agree. grrr. And so sad.

-brewster

The problem is NCUA is purely regulatory. Their only goal is to keep the CUs in compliance and to step in when things start to go south. They don’t want innovation. Most CU CEOs would agree with everything you said, but they are all under the same thumb. The big CUs can handle the expense associated with the constant oversight, but the smaller ones… most end up looking for another CU to acquire them after a few bad audits. It’s either acquisition or NCUA shuts the doors for you.

Our credit union probably lasted longer than most, as we had major donations. We discovered the techniques to even shutter a CU that is no risk to the insurance fund and says yes to all “oversight.”

But times have changed– the technologies are available to build in the compliance enforcement they seem so worried about. CU*Answers makes it difficult to violate many of the rules. Maybe they do not understand how far technology has come.

Any thought of trying to convert from a federal charter to a state one? I don’t know the laws in NJ but you can be federally insured, state chartered. State rules can be somewhat different and allow for different fields of membership, guidelines, etc.

As the former CEO of one of those 200-300 that disappears each year, I will say mergers take a lot just for the reasons mentioned – not enough time in the day to serve members after you factor in the required regulatory work.

However I will say I’m still at a Credit Union and very happy with the work we’ve done and continue to do.

I am very glad you are still involved in credit unions and did not give up. I hope there are more stories that will come out about other Credit Unions that are liquidated. I do understand why most will not come forward, as staying in the field could be quite difficult. We felt it was important if others could learn from our story, even though there are sacrifices.

I do not know much about state charters. What we did discover is there are many solid back-end systems that makes setting up a fully functional credit union quite easy. CU*Answers is one, and we found them really great to work with. So if there were an avenue to get chartered and to be allowed to provide services, then the technical underpinnings are quite doable, replicable, and scalable. And the demand for alternative, local financial services is huge.

-brewster

Is withdrawing from the NCUA an option? My credit union isn’t insured by it, but rather a private nonprofit. Of course that has its own standards and rules, but I’m guessing it’s not as susceptible to meddling by the banking industry as an organization directly subject to the caprices of Congress and other recipients of ABA largesse.

I am not an expert, but I do not believe so. An employee of the San Francisco Fire Credit Union said they were not insured by the NCUA which they were relieved by because that meant that they could not be forced to pick up the pieces of smaller credit unions that were being liquidated by the NCUA. I took this to mean the NCUA had to deal with the pieces if they insured them and they were liquidating.

But, as I understand it, they are much more than just an insurance fund. Even if your federal credit union is not insured by the NCUA, they control the charter and can enforce its rules.

Does anyone know about state chartered credit unions?

Credit Unions have a “dual chartering” system which means you can choose to be federally chartered or state chartered.

The pros of federal is that basically you exist as a government entity, but you have to adhere to the rules of the Federal Credit Union Act. No wiggle room. This is very challenging when it comes to field of membership (ie who can join) and Member Business Lending, specifically.

A state chartered, federally insured credit union can have different rules. Depends on the state. Some states just say “whatever the federal act says” but other states take the regulatory aspect head on. I do not know the specifics in New Jersey, but you may want to check with the NJ Credit Union League and see if they have any ideas for you. They probably are well versed on the state vs federal aspects.

I will say the NCUA still gets involved in “safety and soundness” issues but your regulator would be the state – the state would approve your charter, FOM, etc.

My guess is the biggest issue you’d have is capital. NCUA doesn’t permit secondary capital but some states do. (ie you write a check and voila the credit union has capital). The article doesn’t say why your loans were limited to $5K – but I’m guessing it has to do with the impact a charged off loan would take to your capital ratios.

I’ve never been involved with a start up CU. You might be able to take brokered (non-member) deposits to at least boost your cash, which would enable you to do loans.

I don’t understand why NCUA would kick a group out that appears to be a SEG (ie anyone that’s a member of a specific Farm organization), but certainly if they aren’t documented US Citizens , you’d have BSA and regulatory issues…

I’m happy to try to assist and do what I can. Innovation in the industry does not happen often, and I keep thinking, maybe those ideas would succeed in a larger already established credit union.

International foreign transfers do get a ton of scrutiny.

Happy to discuss further offline if you’d like.

The pros of federal is that basically you exist as a government entity, but you have to adhere to the rules of the Federal Credit Union Act

The pros of federal is that basically you exist as a government entity, but you have to adhere to the rules of the Federal Credit Union Act. No wiggle room. This is very challenging when it comes to field Moda Sitesi of membership and Member Business Lending, specifically.

Pingback: Credit unions | The Socialist Entrepreneur

I wont pretend that I understand the whole of your problems, but have you ever tried to contact other Credit Unions in Canada as an example, to ask for some help as to what they do to survive. I am not an admirer of banks, and have been a member of the credit unions in Duncan B.C and Lake Cowichan B.C. (Canada), since in my late teens, (now 77) Also my Dad and friends started the one in Duncan because of how hard it was to get monies from Banks. I believe most folks do not know that a credit union is there’s, A bank, is not. Hence profits go to others. Anyway….

Ted.

PS good luck!